Greetings, AI Thinkers,

Today, we have a review of Microsoft’s latest advancements in AI, courtesy of an insightful analysis by Michael Lugassy.

Then, my perspective on Microsoft as a $10 trillion company is due to Microsoft’s:

- Focus on developers and IT leaders as part of a long-term strategy.

- Enterprise Market Control

Plus:

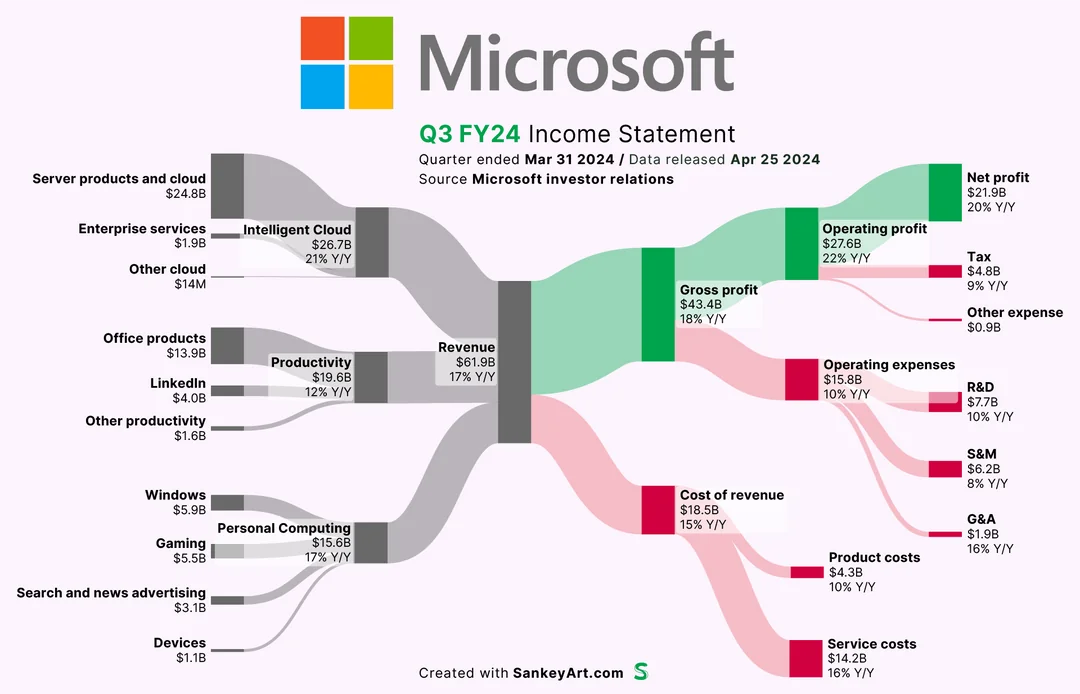

- A visual representation of how they earn and spend their money.

Happy Thinking,

Dr. Yesha Sivan and the MindLi Team

P.S. See visual summary (labs). Feedback? Email me.

Spark of the Week: Microsoft’s AI Play — Playing Soft, Winning Hard (Source: Yesha on Human Thinking)

Last week, Thanks to Michael Lugassi

I have observed Microsoft’s growth over the past 11 years since Satya became CEO. In 2013, Microsoft’s market capitalization was approximately $261.5 billion. As of May 2025, it has risen to about $3.36 trillion. This represents an increase of roughly 1200%.

Before I share my perspective, let me present the latest insights eloquently expressed by Michael Lugassi, a long-time inner maven of modern tech:

In a t-shirt and sneakers, Satya aligned things with an announcement I would summarize as “production-ready.” A product line built slowly and correctly because that’s what Microsoft’s long-time customers demand.

Alignment with other key players:

- Alignment with Google (Gemini) for businesses, with the deep integration of Copilot into Office 365.

- Alignment with Amazon Web Services (AWS) (Bedrock), integrating hundreds of models, a smart router, and the option to train private models.

- Alignment with Cursor, with the rewriting of VS Code as an AI tool with editing capabilities, rather than an editor with AI capabilities.

In terms of code, this goes beyond alignment:

- Tight integration with GitHub will soon make Cursor disappear (will it be sold to Google?).

- GitHub’s cloud code agent will eliminate OpenAI Codex, Claude Code, and competing asynchronous code solutions.

- Satya’s monthly commitment to a fresh version will leave other IDEs behind.

Working with friends:

- Three video calls along the way with Musk, Jensen, and Altman—for all three, Microsoft is a lighthouse and a huge customer.

And this was also present:

- Massive shift to ARM chips (may God help Intel Corporation).

- Deep support for the MCP protocol (perhaps the last thing we’ll remember from Anthropic).

- An attempt to invent another standard for agents called NLWeb.

- And a deep, academic-level research tool that allows any novice with Microsoft Azure credits to solve problems in the universe.

This is a crazy time to invent something. By next week, someone else will have invented it for you.

My Take 1: Weak Innovation (0 to 1), Strong Scaling (1 to 100)

Historically, Microsoft struggled with innovation (zero to one) but excelled at scaling (one to one hundred).

This has been true for DOS, Windows, Internet Explorer, Cloud, and now AI. They were not invented by Microsoft but copied or acquired to scale. (This strategy did not perform well in the mobile market (lost to Apple) and the search market (lost to Google), but overall, it has been successful. This is what they are doing now with AI.

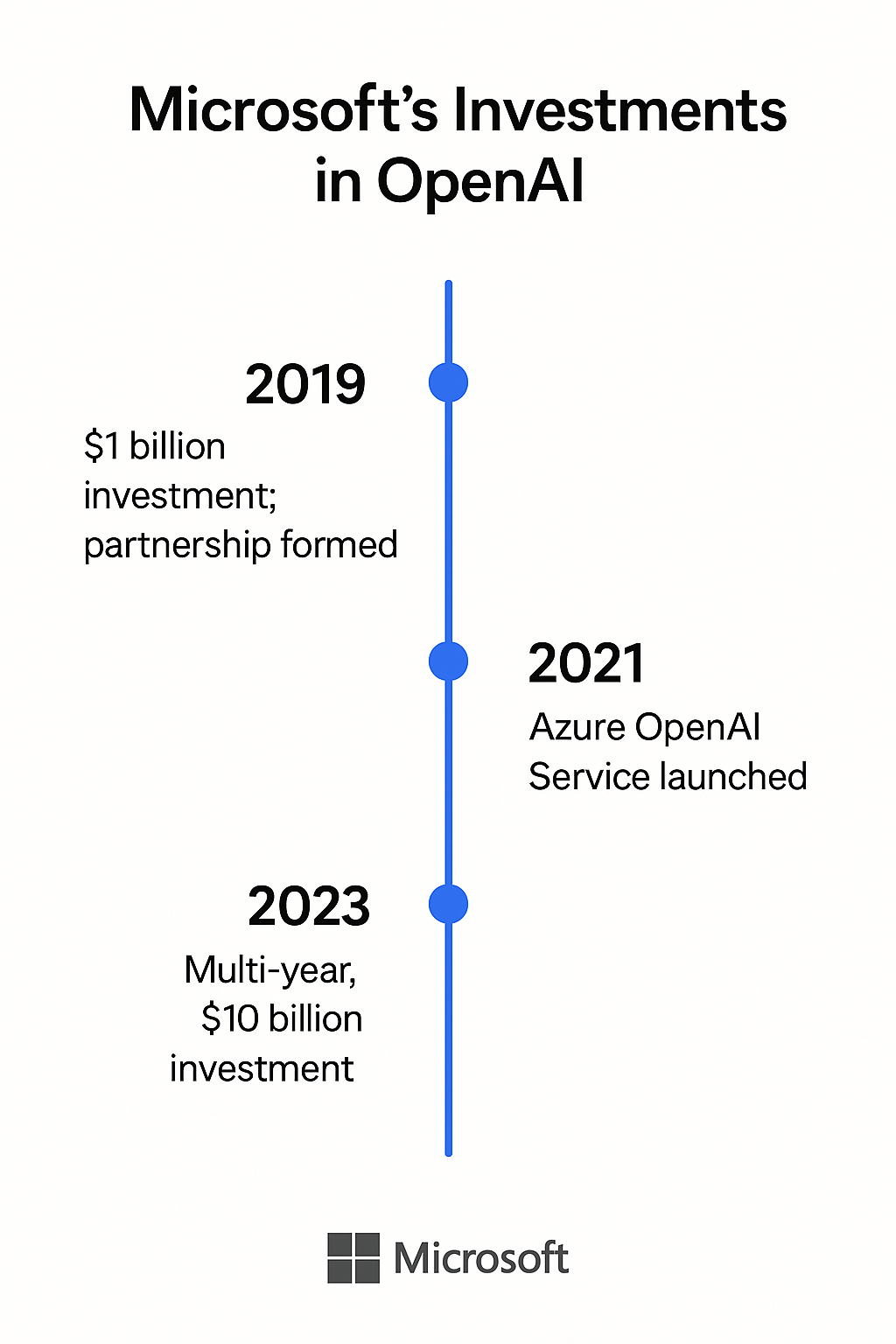

My Take 2: Making Big Bets on OpenAI

Microsoft, under Satya Nadella, is highly aggressive in making bold investments. Their investment in OpenAI practically gave rise to the field of modern AI. As depicted in the following:

- 2019: $1B investment to secure exclusive partnership with OpenAI.

- 2021: Launch of Azure OpenAI Service to commercialize OpenAI models via Azure.

- 2023: $10B+ multi-year investment to deeply integrate OpenAI across Microsoft products (e.g., Copilot in Word, Bing, Teams).

The Strategic Outcome: Early Lock-in enterprise clients, scale Azure, and lead in applied AI.

My Take 3: Diverse Sources of Revenues

Microsoft has a diverse source of income. Here is one depiction from last year (2024Q3):

Bottom line: diverse sources. Unlike Apple, which focuses mainly on the iPhone, or Google, which primarily concentrates on search—an area that is highly profitable.

Conclusion: The Road to a $10 Trillion Microsoft

In the last 10 years, Microsoft has built itself for growth (“growth mindset” was a key theme in Satya Nadella’s book “Hit Refresh: The Quest to Rediscover Microsoft’s Soul and Imagine a Better Future for Everyone”)

Microsoft is in a great position to win the AI race as the leading infrastructure player. Because Microsoft has strategic control:

- Controlling developers has been a great move since buying GIT and promoting Visual Studio Code (the #1 developer tool) — that is now a full “AI peer” (Satya’s term)

- Controlling IT personnel and enterprise decision-makers are crucial for establishing long-term relationships.

- Control the enterprise market (look what Microsoft Teams did to Zoom).

- Controlling revenues — A global, diverse market has many sources of income — less fragile. Google depends on search, Apple on iPhone.

- Control the entire life cycle of AI: chips, cloud, and customers (Azure).

- Willing to play softly with many players, including big bets and cultural change.

My bet: by 2035, Microsoft will be a $10 trillion company.

More Resources

- Microsoft at 50

- Did Microsoft just hijacked MCP and no one noticed? What native MCP…by Reuven Cohen

- Microsoft Build 2025 | Satya Nadella Opening Keynote(video 2 hrs)

- Lots of learning from Microsoft

- My first Microsoft product: Z-80 SoftCard – Wikipedia

- My favorite video of Bill Gates and Steve Jobs together: Macworld Boston 1997-The Microsoft Deal

About MindLi CONNECT Newsletter

Aimed at AI Thinkers, the MindLi CONNECT newsletter is your source for news and inspiration.

Enjoy!

MindLi – The Links You Need

General:

- Website — MindLi.com — All the details you want and need.

- LinkedIn — MindLi 🌍 GLOBAL Group — Once a week or so, main formal updates. ⬅️ Start here for regular updates.

- WhatsApp — MindLi Updates — If you need it, the same global updates will be sent to your phone for easier consumption. This is similar to the above Global group — once a week or so.

- Contact us – We’re here to answer questions, receive comments, ideas, and feedback.

Focused:

- LinkedIn — MindLi 🧠 AI Group — More technical updates on AI, AGI, and Human thinking. ⬅️ Your AI ANTI-FOMO remedy — Almost Daily.

- LinkedIn — MindLi 👩⚕️HEALTHCARE Group — Specifically for our favorite domain — healthcare, digital healthcare, and AI for healthcare — Weekly.

- LinkedIn — MindLi 🛠️ FOW – Future of Work Group — thinking about current and future work? This is the place for you — Weekly.

- LinkedIn — MindLi 🕶️ JVWR – Virtual Worlds Group — About virtual worlds, 3D3C, JVWR (Journal of Virtual World Research), and the good old Metaverse — Monthly.

- LinkedIn — MindLi Ⓜ️ Tribe Group — Our internal group for beta testers of MindLi, by invite — when we have updates, call for advice, need for testing, etc (also ask about our special WhatsApp group).