Greetings AI Thinkers,

In this week’s Leadership CONNECT, we present a comprehensive case study by Michael Bruck – an engineer turned investor and our friend:

He opens:

“The investment management industry stands at a strategic inflection point reminiscent of the seismic shifts I witnessed during my time at Intel. Just as Andy Grove navigated Intel’s pivotal transition from memory chips to microprocessors—a move that redefined the entire computing landscape—today’s investment firms face a similar watershed moment with artificial intelligence.”

You might consider reading Michael’s post twice:

A. as a case study in the investment industry and

B. as a framework to examine how AI impacts an industry.

Happy Thinking,

Dr. Yesha Sivan and the MindLi Team

P.S. Comments, ideas, feedback? Send me an e-mail.

Deep Case Study / Guest Post: AI Transforms Investment Management (Source: Michael Bruck)

Prologue by Yesha Sivan: A Deep Dive to One Industry

This week, Michael Bruck shares detailed insights on how AI will cause “a fundamental architectural transformation in how investment intelligence operates.”

A bit of background about Michael: He started as an engineer at Intel and has developed a global career that spans technology, finance, and venture investing. Now a partner at a UAE-based AI-focused fund, he provides profound insight into the evolution of innovation across continents.

For more info, You can check Michael’s LinkedIn.

This detailed review — please take 30 minutes to read it — is also a template for other industries.

The review includes:

- The Three Horizons of Investment Intelligence (H1, H2, H3).

- Code to Capital: How Software’s AI Adoption Forecasts Investment Management’s Future — and you know my affinity for viewing programming as a precursor to developments in other industries.

- Understanding the Architectural Imperative (looking back on three transitions from paper to computer to mobile).

- The Emerging Team Models (how companies work in the age of AI — Factory vs Artisan.)

- Real-World Transformation: Case Study (concrete projects that change with AI) like how to generate memorandum of investment, newsletter, etc.

- The Vendor Landscape: A Strategic Decision Matrix (specific players in the investment industry).

- Strategic Implementation Roadmap (12-18 months, 18-36 months, 3-4 years).

Here is the case study: “The investment management industry stands at a strategic inflection point reminiscent of the seismic shifts I witnessed during my time at Intel. Just as Andy Grove navigated Intel’s pivotal transition from memory chips to microprocessors—a move that redefined the entire computing landscape—today’s investment firms face a similar watershed moment with artificial intelligence.

What makes this moment particularly significant isn’t merely the integration of new technology but a fundamental architectural transformation in how investment intelligence operates. This isn’t simply about adding AI features to existing platforms; it’s about reimagining the entire infrastructure of financial analysis and decision-making.

The Three Horizons of Investment Intelligence

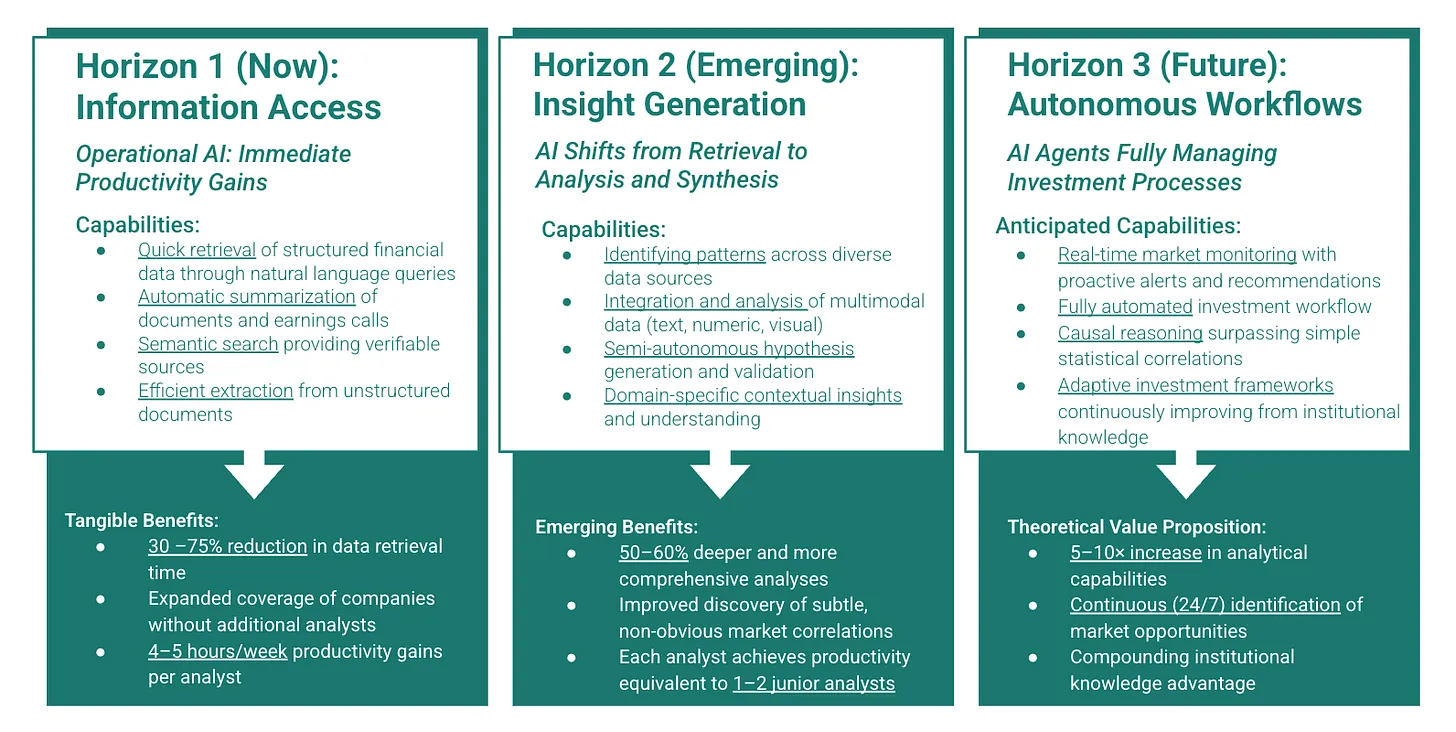

Through my analysis of the rapidly evolving AI landscape, I’ve identified three distinct horizons that map the evolution of artificial intelligence in investment management:

Horizon 1: Information Access (Present Day)

Most investment firms today operate in this initial phase, where AI primarily serves as an enhanced information processing system. Teams leverage tools that summarize earnings calls, extract data from filings and organize market intelligence—valuable capabilities yet fundamentally limited. The technology functions as a bolt-on feature to legacy platforms rather than a reimagined architecture.

The productivity gains here are non-trivial—analysts report 30-75% reductions in data retrieval time and approximately 4-5 hours of weekly time savings—but they represent evolutionary rather than revolutionary advancement. A Bloomberg Terminal with AI-enhanced search remains, at its core, the same analytical paradigm with faster information retrieval.

Horizon 2: Insight Generation (Emerging)

We now stand at the threshold of a more transformative phase where AI evolves from information organization to active insight generation. The foundational technologies enabling this shift include:

- Internet-scale semantic search, which transforms the entire web into a queryable financial database.

- Model Context Protocol (MCP) implementations that seamlessly connect AI systems with disparate data sources.

- Multi-modal analysis frameworks that integrate text, numeric data, and visual information.

The fundamental breakthrough in this horizon is that AI begins to identify patterns across diverse information sources and generate hypotheses autonomously. Early implementations suggest productivity equivalents of adding 1-2 junior analysts to each senior team member.

Yet this remains an intermediate stage in the evolution of investment intelligence.

Horizon 3: Autonomous Workflows (Future)

The ultimate destination—still several years away but clearly visible on the technological horizon—involves a paradigm shift from tools to autonomous systems. This third horizon will introduce:

- Self-directing agent networks that continuously monitor markets without human activation.

- Causal reasoning engines that understand not just correlations but true cause-effect relationships.

- Adaptive knowledge frameworks that learn from institutional experience.

The theoretical potential is staggering: a 5-10x increase in analytical capabilities with 24/7 market monitoring and compounding institutional knowledge advantages. This isn’t about replacing human judgment but exponentially expanding its reach and depth. Software Development: The Canary in the AI Coal Mine

Code to Capital: How Software’s AI Adoption Forecasts Investment Management’s Future

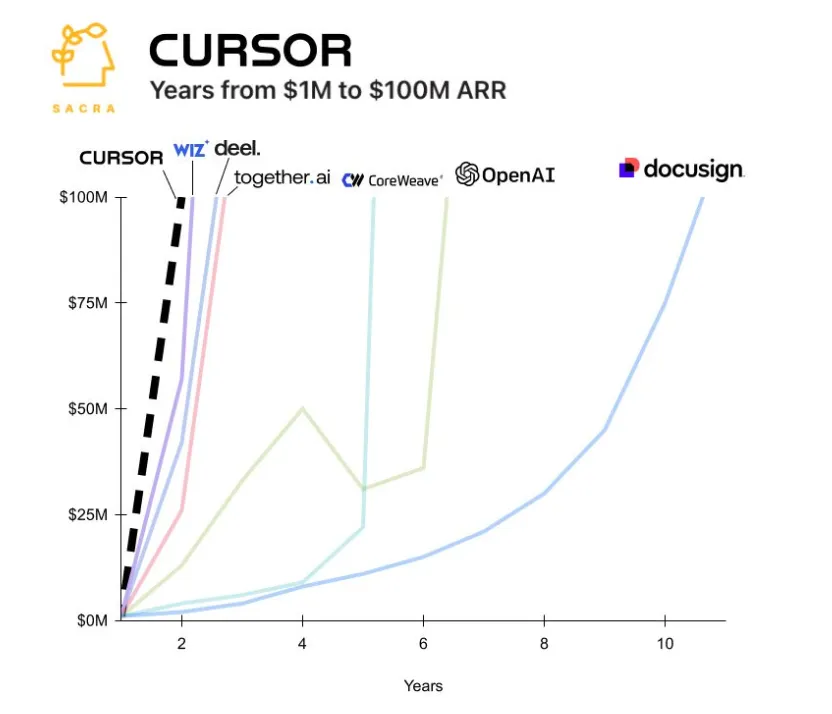

The software development industry provides a compelling preview of the transformation now beginning in investment management. What makes this parallel so instructive is how rapidly software development has progressed from experimental AI implementations to mission-critical operational systems.

The velocity of this transition is perhaps best captured by the meteoric rise of AI-native development platforms. Cursor, for instance, scaled from $1 million to $100 million in annual recurring revenue in just two years—a growth trajectory that outpaces even OpenAI’s ChatGPT. This isn’t merely a story of venture capital exuberance but of fundamental productivity transformation that creates immediate, measurable value.

As Andrej Karpathy, former Tesla AI director, aptly described the shift in a viral X post: “There’s a new kind of coding I call ‘vibe coding,’ where you fully give in to the vibes, embrace exponentials, and forget that the code even exists.” This represents more than hyperbole—it captures how AI is fundamentally altering the interaction model between knowledge workers and their craft. The technology enables professionals to operate at a higher level of abstraction, focusing on intent and outcomes rather than implementation details.

Most critically for investment management, software development’s AI transformation demonstrates that knowledge-intensive work—previously considered immune to significant productivity disruption—can experience order-of-magnitude efficiency gains when properly restructured around AI-native architectures. Just as developers now accomplish in hours what previously required days, investment analysts are poised for similar productivity leaps.

This transition follows a consistent pattern: initial adoption focused on basic assistance tools, followed by collaborative insight generation, and ultimately advancing toward autonomous capabilities. The compression of this adoption cycle in software development—from early experimentation to mainstream deployment in less than 18 months—suggests that investment management’s transformation may unfold far more rapidly than conventional wisdom anticipates.

The investment firms that recognize this parallel and accelerate their own architectural transitions will likely establish sustainable competitive advantages, while those that view AI as merely an incremental enhancement risk falling irretrievably behind.

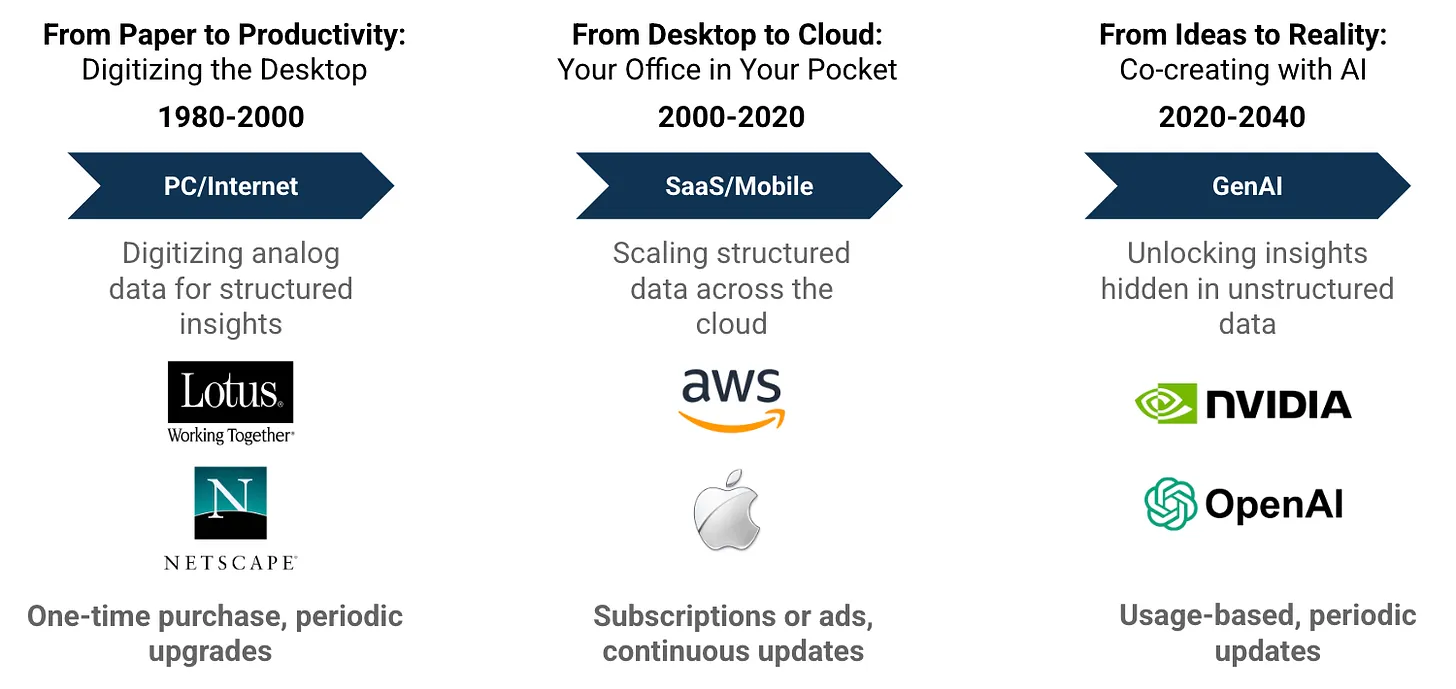

Understanding the Architectural Imperative

Just as the PC era demanded fundamentally different architectures than mainframe computing, and cloud computing required rethinking the entire infrastructure stack beyond traditional server farms, AI-native architectures demand a ground-up reimagining of how investment intelligence operates.

Consider the limitations of simply adding AI features to legacy platforms: enhanced search in a traditional terminal might deliver 20-30% productivity improvements at best. By contrast, systems designed around AI capabilities from inception can deliver the 10x productivity leap that represents true transformation.

The Emerging Team Models

As AI capabilities advance, investment teams are evolving toward two distinct but complementary human-AI collaboration patterns that I’ve termed the “factory” and “artisan” models:

The “Factory” Model

In this approach, autonomous AI agents handle predictable, routine processes like monitoring financial metrics, screening securities, or extracting data from filings. Human supervision remains, but the primary workflow is systematic and scalable. Early implementations have shown teams completing analytical tasks in half the traditional time through AI orchestration.

The “Artisan” Model

Here, AI functions more as an assistant augmenting experienced investment professionals in scenarios requiring judgment and creativity—complex portfolio construction, novel investment thesis development, or emerging market analysis. The AI serves as a thought partner, helping generate ideas and test hypotheses without replacing human decision-making.

What’s particularly interesting is how the most sophisticated investment firms are strategically blending these approaches based on the specific workflow. Systematic monitoring might leverage the factory model, while thesis development follows the artisan approach—with AI seamlessly bridging both modes.

Real-World Transformation “71 Capital” Case Study

The abstract potential of AI in investment management becomes concrete when examining implementations we’ve pioneered at 71 Capital:

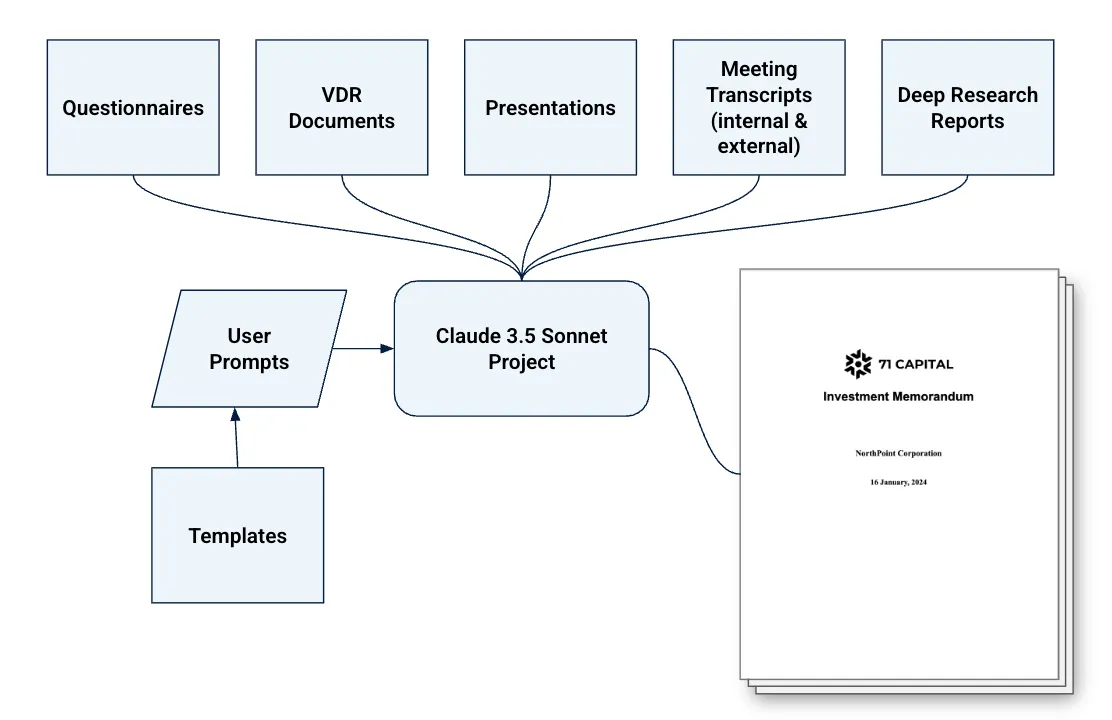

Investment Memorandum Creation

At 71 Capital, one of our most successful AI implementations has been our structured document creation system for investment memorandums. The traditional process for generating these large and detailed documents was manual and labor-intensive, requiring weeks of analyst time to compile information from various sources—questionnaires, virtual data room documents, management presentations, meeting transcripts, and deep research reports.

By implementing a workflow-based system utilizing Claude 3.5 Sonnet alongside a programmatic workflow editor, we’ve achieved an order-of-magnitude reduction in production time. The system seamlessly synthesizes diverse inputs into structured, coherent, and high-quality investment documents for our Investment Committee.

What’s particularly noteworthy is that this represents a workflow rather than an agent approach. The process demands predictable outcomes and standardized formats—exactly the type of structured, consistent process where a workflow approach shines. An agent, with its emphasis on autonomy, would be less suitable for this task, where format adherence and predictability are paramount.

Customized Intelligence Newsletters

Another transformative implementation at 71 Capital has been our customized intelligence newsletter system. This three-stage process perfectly illustrates the evolution from basic data gathering to sophisticated AI-powered synthesis:

First, we scrape and gather data from various websites and online sources, creating a diverse pool of raw and unstructured information. Next, scheduled automated cron jobs systematically extract, structure, and store this web data in an organized database, ensuring reliable and consistent updates.

The true breakthrough comes in the final stage, where we use Large Language Models to aggregate, synthesize, and summarize this structured data into concise newsletters. This has dramatically reduced daily reading time from approximately two hours to around 10 minutes—an efficiency gain that multiplied across our entire team represents thousands of hours annually redirected toward higher-value analysis.

Again, this implementation leverages a workflow rather than an agent approach because the data sources are known and predictable, ensuring consistent outputs and format adherence. The structured automation provides the standardization and reliability our investment process demands.

Research Workbench Platform

Perhaps our most sophisticated AI implementation at 71 Capital has been our Research Workbench platform, which represents an evolution beyond traditional workflows toward what we call a “pseudo-agent” architecture. Unlike our customized newsletter system, which follows a fixed, structured process designed for standardized outputs, the Research Workbench employs a fundamentally different approach.

This pseudo-agent dynamically selects from a diverse toolkit—including a RAG Knowledge Base, internet search capabilities, and specialized analytical instruments—based on the specific query at hand. The contextual intelligence of this system allows it to navigate complex, unpredictable information requests with remarkable flexibility.

What distinguishes this approach from a pure workflow is its adaptive nature. Rather than following predetermined pathways, the system evaluates each query independently, selects optimal information retrieval strategies, and synthesizes responses tailored precisely to the analyst’s needs. This contextual awareness enables the platform to effectively handle the varied and complex questions that emerge during the investment research process.

The core architecture integrates several advanced components: a comprehensive RAG Knowledge Base containing our proprietary research and analysis, dynamic internet search capabilities that extend beyond our internal data, contextual tool selection mechanisms that identify the most appropriate analytical approach for each query, integration with OpenAI’s ChatGPT (o3-mini), and multi-user collaboration features that allow our entire investment team to leverage and contribute to the platform’s capabilities.

The impact has been transformative, significantly reducing hours of research into concise, insightful summaries that address precisely what our analysts need to know. This evolution toward more agent-like behaviors while maintaining the reliability of structured workflows represents exactly the kind of architectural innovation that defines the transition between our second and third horizons of AI implementation.

Deep Research Integration

Our most advanced AI implementation at 71 Capital is our Deep Research platform, which represents a further evolution of our Research Workbench into truly agent-based territory. This system addresses broader, more open-ended questions compared to structured tasks like Investment Memorandums, requiring less rigid frameworks and more adaptive methodologies.

The fundamental architecture follows an iterative research loop that begins with clearly defined research objectives and parameters for exploration depth and breadth. From there, the system enters a sophisticated research cycle:

1. Intelligent Query Generation: The agent autonomously formulates targeted queries aligned with research goals, adapting its approach based on emerging information.

2. Parallel Web Searches: The system concurrently searches across multiple sources to efficiently gather comprehensive information, operating across diverse data landscapes simultaneously.

3. Results Processing: More than mere collection, the system analyzes and synthesizes findings to identify actionable insights, connecting disparate information points into coherent narratives.

4. Recursive Exploration: Perhaps most impressively, the system continuously deepens research by iteratively refining and expanding queries based on insights, navigating research paths that human analysts might miss.

Throughout this process, the agent maintains contextual awareness, continuously incorporating new findings to ensure all subsequent actions remain aligned with the original research objectives. The output consists of structured, comprehensive markdown reports complete with actionable insights, references, and citations.

This approach dramatically differs from traditional research workflows in its flexibility and context-awareness. For example, when we tasked the system with researching statistical arbitrage strategies across centralized and decentralized exchanges, it autonomously generated a sophisticated 30-page analysis in just 10 minutes—work that would have required days with traditional research approaches.

The critical innovation in our Deep Research platform is its ability to handle complex, evolving contexts. The system excels at generating comprehensive analysis for technical subjects like algorithmically-driven trading strategies, beginning with well-formulated queries, proceeding through clarification dialogues, and eventually producing structured reports that include sophisticated elements like pseudocode for implementation.

As the agent ecosystem continues evolving, we’ve carefully tracked the emerging competitive landscape across leading LLM platforms. When Gemini 1.5 Pro first piloted deep research capabilities, it set high benchmarks by integrating tightly with Google’s ecosystem. However, ChatGPT quickly established dominance in complex analytical tasks that appeal to technical professionals. More recently, Perplexity has carved out a niche through rapid, interactive insights, while You.com targets enterprise-grade research demands, and xAI’s Grok has made headlines with its uniquely real-time, social data-driven approach.

These platforms differ significantly in performance characteristics—from Perplexity’s rapid 2-4 minute processing to ChatGPT’s more thorough 30-minute deep dives, from source coverage ranging from ChatGPT’s limited 25 sources to You.com’s impressive 400+ simultaneous source processing. Each platform has carved distinct specializations, whether in technical research, coding tasks, market analysis, or real-time trend monitoring.

This competitive innovation cycle is precisely why we’ve designed our systems to be platform-agnostic, allowing us to leverage each model’s strengths while mitigating their individual limitations. The result is an adaptive research capability that significantly expands our analytical horizon while maintaining the critical human judgment that defines our investment philosophy.

The Vendor Landscape: A Strategic Decision Matrix

Investment firms now navigate a complex decision landscape regarding AI implementation, choosing between AI-native startups and enhanced incumbent platforms:

AI-First Platforms

A wave of specialized vendors has emerged, including:

- Perplexity for Finance: Combining conversational interface capabilities with authenticated financial data sources.

- AlphaWatch: An “AI copilot for hedge funds” integrating external financial data with proprietary information.

- Brightwave: An AI research assistant generating financial analysis by synthesizing earnings reports and filings.

These pure-play AI platforms often introduce innovative features ahead of incumbents and cater to specific niches within the investment workflow.

Enhanced Incumbent Platforms

Traditional market data providers are actively embedding AI capabilities:

- Bloomberg: Developed BloombergGPT (a 50-billion parameter finance-trained LLM) and integrated AI-written earnings summaries.

- FactSet: Launching generative AI search and conversational APIs.

- S&P Global: Implementing AI-enhanced search and data integration across its platforms.

Incumbents benefit from trusted data and compliance frameworks while often struggling to fundamentally reimagine their architectures.

The emerging industry pattern isn’t one vendor category displacing the other but rather a complex ecosystem where both approaches address different aspects of the investment process. Many sophisticated firms maintain relationships with traditional data providers while selectively integrating specialized AI tools for specific use cases.

Strategic Implementation Roadmap

For investment organizations navigating this transformation, I recommend a phased approach that balances immediate gains with long-term architectural advantages:

Near-Term (12-18 months)

- Evaluate platforms based on their architectural roadmap toward AI-native capabilities.

- Prioritize systems that support universal connectivity standards.

- Build internal competencies in prompt engineering and AI workflow design.

Medium-Term (18-36 months)

- Implement internet-scale semantic search capabilities.

- Develop hybrid workflows combining human judgment with emerging AI capabilities.

- Restructure research processes to leverage multi-modal data integration.

Long-Term (3-5 years)

- Prepare organizational structures for autonomous AI workflows.

- Design governance frameworks for agent-based systems.

- Develop performance metrics for measuring AI-augmented analyst effectiveness.

The Fundamental Thesis: AI as Force Multiplier

The central argument that I’ve been advancing to investment leaders is that AI represents not merely an incremental improvement but a fundamental force multiplier for investment professionals. When properly implemented through AI-native architectures, these technologies promise:

- Comprehensive market intelligence spanning the entire web rather than just subscribed databases.

- Expansion of research coverage from dozens to hundreds of companies per analyst.

- Enhanced competitive intelligence through continuous monitoring of market trends.

- Accelerated investment thesis generation, reducing research cycles from weeks to hours.

This force multiplier effect—potentially increasing productivity by an order of magnitude—represents a competitive imperative for investment firms. The organizations that recognize this architectural evolution and position themselves to capture the transformative benefits of truly AI-native systems will likely establish compounding advantages, while those implementing superficial AI features risk falling behind.

The journey to fully AI-native investment operations is still unfolding, but the trajectory is clear: AI is evolving from experimental technology to the fundamental infrastructure of modern investment management. Just as previous technological revolutions created clear winners and laggards, this AI transformation in investment management will likely reward the architecturally astute and strategically bold.

About MindLi CONNECT Newsletter

Aimed at AI Thinkers, the MindLi CONNECT newsletter is your source for news and inspiration.

Enjoy!

MindLi – The Links You Need

General:

- Website — MindLi.com — All the details you want and need.

- LinkedIn — MindLi 🌍 GLOBAL Group — Once a week or so, main formal updates. ⬅️ Start here for regular updates.

- WhatsApp — MindLi Updates — If you need it, the same global updates will be sent to your phone for easier consumption. This is similar to the above Global group — once a week or so.

- Contact us – We’re here to answer questions, receive comments, ideas, and feedback.

Focused:

- LinkedIn — MindLi 🧠 AI Group — More technical updates on AI, AGI, and Human thinking. ⬅️ Your AI ANTI-FOMO remedy — Almost Daily.

- LinkedIn — MindLi 👩⚕️HEALTHCARE Group — Specifically for our favorite domain — healthcare, digital healthcare, and AI for healthcare — Weekly.

- LinkedIn — MindLi 🛠️ FOW – Future of Work Group — thinking about current and future work? This is the place for you — Weekly.

- LinkedIn — MindLi 🕶️ JVWR – Virtual Worlds Group — About virtual worlds, 3D3C, JVWR (Journal of Virtual World Research), and the good old Metaverse — Monthly.

- LinkedIn — MindLi Ⓜ️ Tribe Group — Our internal group for beta testers of MindLi, by invite — when we have updates, call for advice, need for testing, etc (also ask about our special WhatsApp group).